Low Rate Auto Loans – Look beyond the Monthly Payments

Buying a new car is never easy. A lot of information is required while searching for the best auto loan deals. Auto loans can be difficult to understand, but with a little homework, you can grab the best deal with low interest rates.

Do not be a Careless Car Buyer

When you enter the automobile market to buy a new car, you should look for auto lenders that provide quick approval, dedicated customer support and low interest rate. It is important to clarify your doubts before signing the loan contract. If you sign the loan contract without asking enough questions, you will have to accept whatever terms the lender offers to you.

Usually, car buyers look at the monthly payment amount and if it’s low, they sign the loan contract. They do not even take note of the loan terms, interest rates or the actual price of the car. Remember that if you refrain from doing homework before applying for an auto loan and behave like a careless car buyer, you will end up with high interest rates.

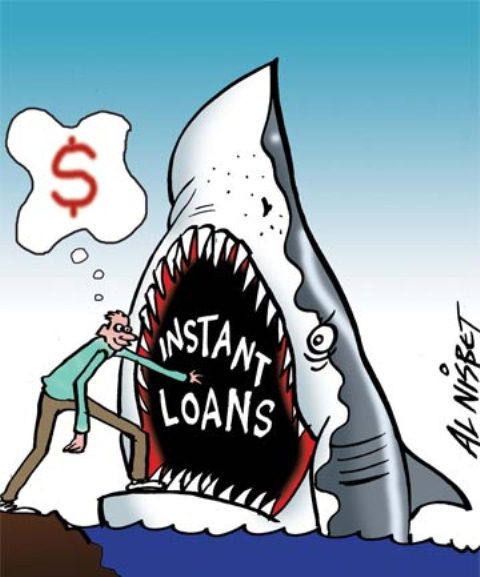

Beware of Loan Sharks

A loan shark is always looking for a victim. Usually, loan sharks are unlicensed money lenders. They provide little or no paperwork to car buyers. They don’t even provide clarity to you about the interest rates on the auto loan.

On-Hand Advice for Finding Low Rate Auto Loans

- Take your time to understand the different types of interest rates.

- It’s important to know the monthly payments towards your car.

- Calculate how much you’re actually paying for the car with the help of an online auto loan calculator.

- Explore other auto loan deals.

- Watch out for a loan shark. They may seem friendly at first, but borrowing from them is never a good idea.

- Compare interest rates from other sources such as banks, credit unions and online auto financing companies.

- Always know your credit score because a good credit score will fetch you a better interest rate.

- Don’t sign up for a longer auto loan term. It is because you will end up paying more money towards interest.

- Be aware of the add-ons such as chrome plating wheels, wheel locks, seat-warmers, etc. When you purchase add-ons from the dealer, it gets added in the auto loan amount which means you have to pay more interest in the long run.

When you apply for an auto loan, you must consider several factors carefully and then, make a decision. It is important know the monthly payments as well as the interest rates before signing the loan contract. Remember that if you are careless car buyer, you will not be able to get a low rate auto loan deal.